SMSF Property Valuation

The trusted team at McLennan, Steege, Smith has launched a new division to cater for the growing Australian trend of property purchases through self-managed superannuation funds (SMSF).

SMSF Property Valuations launched as a division of McLennan, Steege, Smith and Associates.

More people are setting up self-managed Super Funds than ever before – this growth, coupled with changes to the law means that qualified property valuations now form an important element of decision making and compliance requirements.

The ATO recommends that that assets owned by SMSF’s should be re-valued every three years to establish their current market value.

While the team at SMSF will draw on the experience, knowledge and expertise of McLennan Steege Smith formed in 1999, they will also provide a unique product offering that caters specifically for the SMSF market.

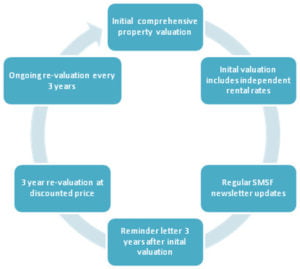

The SMSF Property Valuations product offering includes:

• A comprehensive initial valuation at the time of purchase or transfer of the domestic or commercial property into the SMFS with minimal disruption for current tenants

• A reminder service that lets customers know in writing when their next 3 year valuation is due

• A comprehensive valuation every three years

• Provide a reduced rate for 2nd and subsequent property valuations

• Regular and informative updates to keep customers informed about changes to the SMSF marketplace

• Provide an independent review of current market rental rates for SMFS properties as part of each valuation

SMSF Property Valuations customer relationship process:

Superannuation is often a complex issue for many Australians and we believe it is SMSF Property Valuations job to work with clients to make things as easy and transparent as possible.

We are confident that we can help because we know property valuation and we know customer service.

Email us at info@smsfpropertyvaluations.com.au to find out how we can help.

Social